India is at the forefront of a fintech revolution that is redefining how credit is accessed, disbursed, and repaid. Traditional banks relied heavily on credit scores, physical documentation, and slow manual processes for decades. This excluded millions, particularly small business owners, gig workers, and rural populations, from accessing formal credit. Today, thanks to innovations in financial technology, loans can be approved within minutes, based on alternative credit data and digital footprints. According to a 2024 report by IBS Intelligence, fintechs now hold a 52% market share in personal loans, with ₹2.48 lakh crore in disbursals. This shift is more than technological—it’s structural and social, bringing financial inclusion to the doorstep of every Indian. This blog explores the evolution of India’s credit ecosystem, fintech’s transformative role, real-world applications, and what the future holds for borrowers, lenders, and policymakers alike.

A. From Paperwork to Algorithms: The Background of Fintech Credit

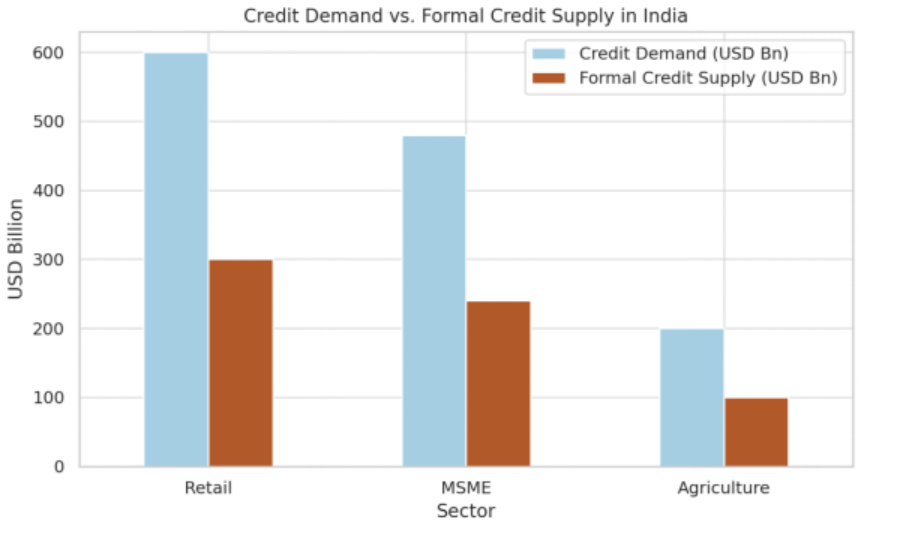

India’s traditional lending infrastructure was built for salaried individuals with bank statements and credit scores. But what about the 450 million workers in the informal sector? Or the 63 million MSMEs that form the backbone of the economy? Until recently, these groups were underserved due to: Lack of formal credit history, Rigid collateral requirements and, Manual KYC and document checks. Leveraging digital identity (Aadhaar), mobile penetration, and UPI, fintech lenders like LendingKart, KreditBee, and Slice have created credit models based on alternative data. These models analyze utility bill payments, smartphone usage, and transaction behavior to build a digital profile of borrowers, offering them personalized credit even without a CIBIL score.

Government Infrastructure Boost: Key policy and digital enablers include:

● Aadhaar & eKYC – enabling instant identity verification

● UPI & Digital Payments – seamless transaction records

● Account Aggregator Framework – unified access to financial data

● OCEN (Open Credit Enablement Network) – democratizing credit delivery

Real-World Impact

1. MSME Lending: Bridging the $240 Billion Gap

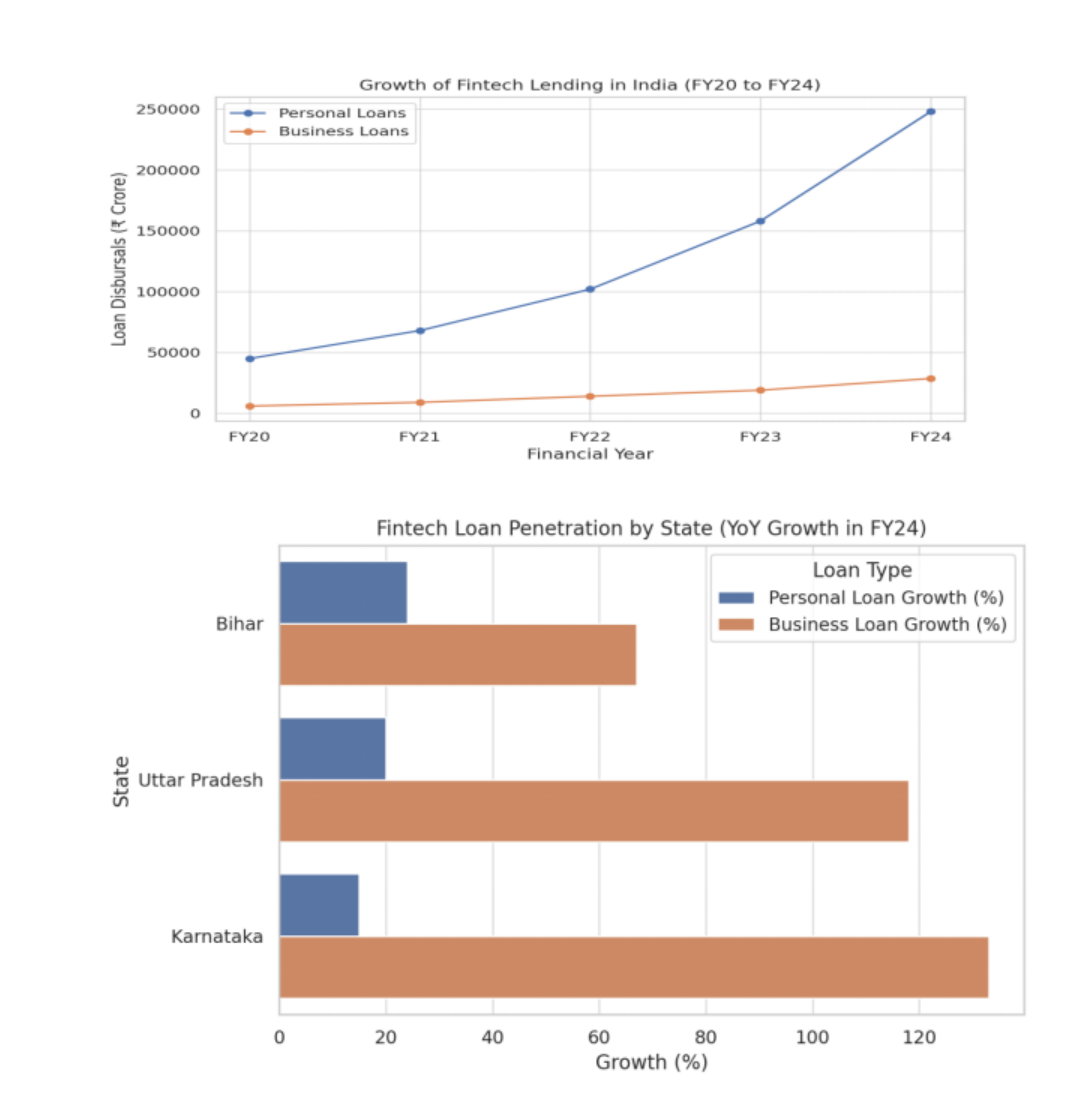

MSMEs often lack proper accounting or tax returns. Fintech players like Indifi and NeoGrowth use GST data and POS transactions to underwrite loans. In Bihar and Uttar Pradesh, digital lending has seen over 60% YoY growth, especially for small vendors and service businesses.

2. P2P Lending:

Crowd-Driven Credit- Platforms like Faircent and LenDenClub match individual borrowers and lenders, reducing dependency on banks. These platforms use algorithms to assess risk and diversify lender portfolios.

3. Buy Now, Pay Later (BNPL)-

In urban and semi-urban India, BNPL platforms like LazyPay and ZestMoney are offering zero-cost EMI options to millennials and Gen Z consumers at the checkout stage of e-commerce platforms. According to RedSeer, India’s BNPL market is expected to reach $40 billion by 2026.

4. Rural Penetration through Mobile Credit- Fintech models are now reaching Bharat—not just India. Digital lenders have seen:

● 24% personal loan growth in Bihar

● 133% business loan growth in Karnataka

● 118% business loan growth in Uttar Pradesh

Source: IBS Intelligence (2024)

C. Trends and Challenges in Fintech Credit

Emerging Trends

● AI-Powered Underwriting: Deep learning models replace rule-based algorithms for smarter risk assessment.

● Embedded Finance: Credit offerings will become part of every digital experience—from food delivery to healthcare.

● Blockchain for Credit History: Decentralized, tamper-proof records can offer borrowers more control over their data.

Challenges Ahead

● Data Privacy & Consent: With so much personal data in play, consent frameworks under DPDP Act 2023 must be enforced.

● Over-borrowing: BNPL models, while convenient, can create invisible debt burdens for young consumers.

● Regulatory Arbitrage: Some unregulated or semi-regulated fintechs may exploit legal gray areas, which the RBI is actively working to address.

Academic Insights

Research in behavioral finance indicates that real-time nudges (e.g., payment reminders or financial health scores) can reduce defaults by 18%. Integrating such features into lending apps can combine access with responsibility.

Conclusion

India’s new credit system, powered by fintech, represents more than innovation—it represents inclusion. By leveraging technology, data, and digital infrastructure, fintech platforms are helping millions access credit with speed, fairness, and personalization. While challenges around privacy and regulation persist, the momentum is clear: India is building a credit economy that serves all, not just a few.

FAQs

Q1. How do fintech lenders assess credit without a CIBIL score?

They use alternative data such as mobile bills, UPI transactions, GST filings, and e-commerce behavior.

Q2. Are fintech loans safe and regulated in India?

Yes. RBI has released digital lending guidelines (2022–24) to ensure customer protection, transparency, and data privacy.

Q3. What is the Account Aggregator Framework?

It’s a digital consent-based system allowing users to share financial data with lenders securely and instantly.

Q4. What are the benefits of P2P lending?

P2P platforms connect individual lenders and borrowers, offering lower interest rates and wider access to funds.

Q5. Can rural borrowers access fintech credit?

Absolutely. Digital lending platforms have expanded rapidly into Tier II & III cities, aided by Aadhaar and mobile access.

Q6. What is OCEN and how does it help?

OCEN (Open Credit Enablement Network) is a framework that allows any app to become a loan service provider, making credit more accessible.

.png)